Understanding Life Insurance: A Comprehensive Guide

Introduction:

Life insurance is a financial tool that provides peace of mind and financial security to you and your loved ones. However, navigating the world of life insurance can be overwhelming due to the various types and terminology. In this comprehensive guide, we will break down the intricacies of life insurance, making it easier for you to make informed decisions about your financial future.

What is Life Insurance?

Life insurance is a contract between you and an insurance company. You pay regular premiums, and in return, the insurance company promises to pay a lump sum, known as the death benefit, to your beneficiaries upon your passing. This financial safety net ensures that your loved ones are taken care of financially when you are no longer around.

Types of Life Insurance

There are primarily two types of life insurance:

Term Life Insurance:

- Provides coverage for a specified term, typically 10, 20, or 30 years.

- Affordable premiums.

- Pays out the death benefit if the insured person passes away during the term.

- Ideal for covering temporary needs, like a mortgage or children’s education.

Permanent Life Insurance:

- Provides lifelong coverage.

- Includes two main subtypes: Whole Life and Universal Life.

- Accumulates cash value over time, which can be used for loans or withdrawals.

- Generally, higher premiums than term life insurance but offers long-term financial benefits.

Why Do You Need Life Insurance?

Life insurance is essential for several reasons:

- Financial Protection: It ensures that your family has the financial means to cover expenses such as mortgages, debts, and daily living costs in your absence.

- Income Replacement: If you are the primary breadwinner, life insurance can replace your income, allowing your family to maintain their standard of living.

- Legacy and Estate Planning: Life insurance can be used to leave a financial legacy or cover estate taxes, ensuring your assets go to your chosen beneficiaries.

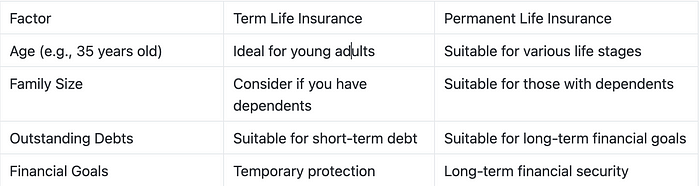

Assessing Your Insurance Needs

Determining how much life insurance you need involves considering factors such as your age, income, family size, outstanding debts, and financial goals. An insurance professional, like Ernest, can help you calculate the ideal coverage amount tailored to your unique circumstances.

INDEX UNIVERSAL LIFE (IUL)

This insurance product is the most demanded in the market today due to its great components and value. This product has protection, a saving component ( cash value), living benefits, and tax advantage. It reduces, if not eliminates, the three financial risks to everyone living today.

The question of a sudden death that leaves financial burden to family will be taken care of. When it is a question of one losing the ability to work which constitutes a fiancial risk, IUL disburses 2% percent of death benefit in the case of long term care, 90% for the terminal illness and a percentage for critical illnesses.

IUL has tax advantages that free withdrawals and loans from the cash values are federal tax-free. The loans come with no interest, collateral, or payable since they are taken against the death benefit.

Index Universal life insurance products also guarantee 7% interest growth. This is what gave thos product age over every products in the market. We offer this product to millions of our customers in Transamerica, Nationwide, Prudential, Pacific life, and many other product providers for our organization.

Are you ready to take the first step towards securing your family’s financial future? Let us help you find the perfect life insurance solution tailored to your unique needs. By filling out this form, you’ll take a significant step towards peace of mind and financial security for yourself and your loved ones. Our experienced advisor, Ernest, will get in touch with you to provide personalised guidance and answer all your questions. Don’t wait; secure your family’s well-being today!

Selecting the Right Policy

Choosing the right life insurance policy requires careful consideration. Work with an experienced advisor like Ernest, who can guide you through the selection process. Factors to weigh include your budget, long-term financial goals, and the length of coverage needed.

Reviewing and Updating Your Policy

Life changes over time, and so do your insurance needs. Regularly reviewing your policy with a trusted advisor ensures it remains aligned with your financial goals and circumstances.

Conclusion:

Life insurance is a crucial component of your financial strategy, providing security and peace of mind for your loved ones. Understanding the various types of policies, assessing your needs, and working with a knowledgeable advisor like Ernest can help you make the best choices for your financial future. By taking this step, you’re not only securing your family’s well-being but also investing in your own financial peace of mind.